Your Terms Stake: A Comprehensive Guide

Understanding investment strategies is crucial for anyone looking to make informed decisions in the financial landscape. One such strategy gaining traction is the concept of your terms stake, which allows investors to leverage their stakes effectively. In this article, we delve into the intricacies of staking, its implications, and how you can optimize your investments using this approach.

What Is Staking?

Staking is the process of participating in the proof-of-stake (PoS) validation of crypto transactions. It involves locking up a particular amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return for staking their coins, investors receive rewards, typically in the form of additional coins or tokens. Staking acts as a mechanism to secure the network and validate transactions, making it an essential component of many modern blockchain platforms.

The Importance of Your Terms Stake

Your terms stake refers to the specific conditions and criteria you set when engaging in staking. This can include the duration of your stake, the amount of cryptocurrency you’re willing to lock up, and the expected returns. Setting clear terms is vital as it dictates how your investments behave and what risks you might incur. Understanding your terms stake helps you align your staking strategy with your financial goals, risk tolerance, and market conditions.

How to Set Your Terms Stake

Setting your terms stake involves several considerations:

- Investment Duration: Determine how long you are willing to lock your assets. Short-term staking can allow for more flexibility, while long-term stakes may provide higher rewards due to compounding effects.

- Amount of Cryptocurrency: Decide how much of your crypto portfolio you want to stake. It’s crucial not to stake more than you can afford to lose.

- Desired Returns: Understand the potential returns from your staking strategy, and ensure they meet your financial expectations.

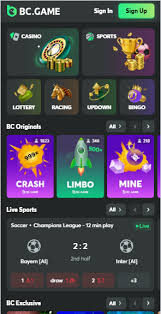

- Choosing the Right Platform: Research different platforms that offer staking services, as they may have varying terms, fees, and reward structures.

Benefits of Staking

Staking can offer numerous advantages for investors:

- Passive Income: By staking your cryptocurrency, you can earn rewards in a relatively hands-off manner, allowing your investment to generate income over time.

- Network Security: Participating in staking helps maintain the security and efficiency of the blockchain network, contributing to the overall health of the ecosystem.

- Potential for Higher Returns: Depending on the cryptocurrency and the staking conditions, rewards from staking can be more lucrative than traditional investment methods.

Risk Factors to Consider

While staking presents many benefits, it also comes with inherent risks:

- Market Volatility: Cryptocurrency values can fluctuate significantly, which might affect the overall returns on your staked assets.

- Lock-Up Periods: Many staking platforms require you to lock your funds for a specified period, which can reduce your liquidity.

- Protocol Risks: Bugs, hacks, or failures in the blockchain protocol can lead to loss of funds, so always research the project thoroughly before staking.

Strategies for Successful Staking

To maximize your staking rewards, consider the following strategies:

- Diversification: Spread your investments across multiple staking platforms and cryptocurrencies to reduce risk and increase potential returns.

- Regular Monitoring: Keep an eye on market developments and your staking performance to adjust your terms stake as needed.

- Utilize Staking Pools: Join staking pools if you are starting with a smaller investment. Pools allow multiple investors to combine their resources, increasing their chances of earning rewards.

Conclusion

Your terms stake plays a crucial role in determining the success of your staking investments. By understanding this concept and setting clear terms, you can enhance your staking strategy, making it more aligned with your financial goals. Always remember to do thorough research and remain mindful of the risks involved. With the right approach, staking can be a rewarding way to engage in the cryptocurrency space.

Leave a Reply